Us Gaap Resumen

US GAAP or IAS and domestic GAAP or IAS the markets have developed a Coping Mechanism Gornik-Tomaszewski Rozen 1999 or a Multiple Principle Capability Choi and Mueller 1992 to deal with different GAAP regimes to value stocks4.

Us gaap resumen. Los Us Gaap abarcan un volumen masivo de estándares interpretaciones opiniones y boletines y son elaborados por el FASB Directorio de Estándares de Contabilidad Financiera el gremio contable AIACP y el SEC Securities and Exchange Comisión Los Us. Ya está disponible la quinta edición de esta exitosa guía que resume las principales diferencias entre las normatividades contables más empleadas en México. However for ease of reference we typically refer to public entities vs non-public entities with more nuanced discussion included in the appendix.

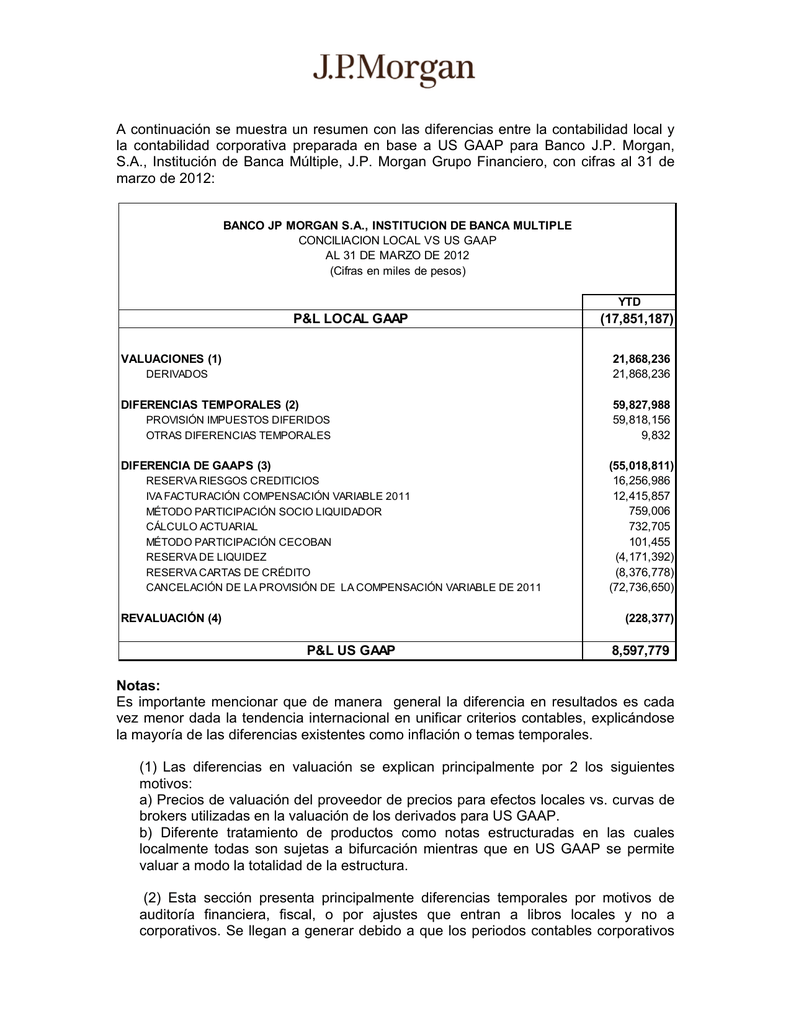

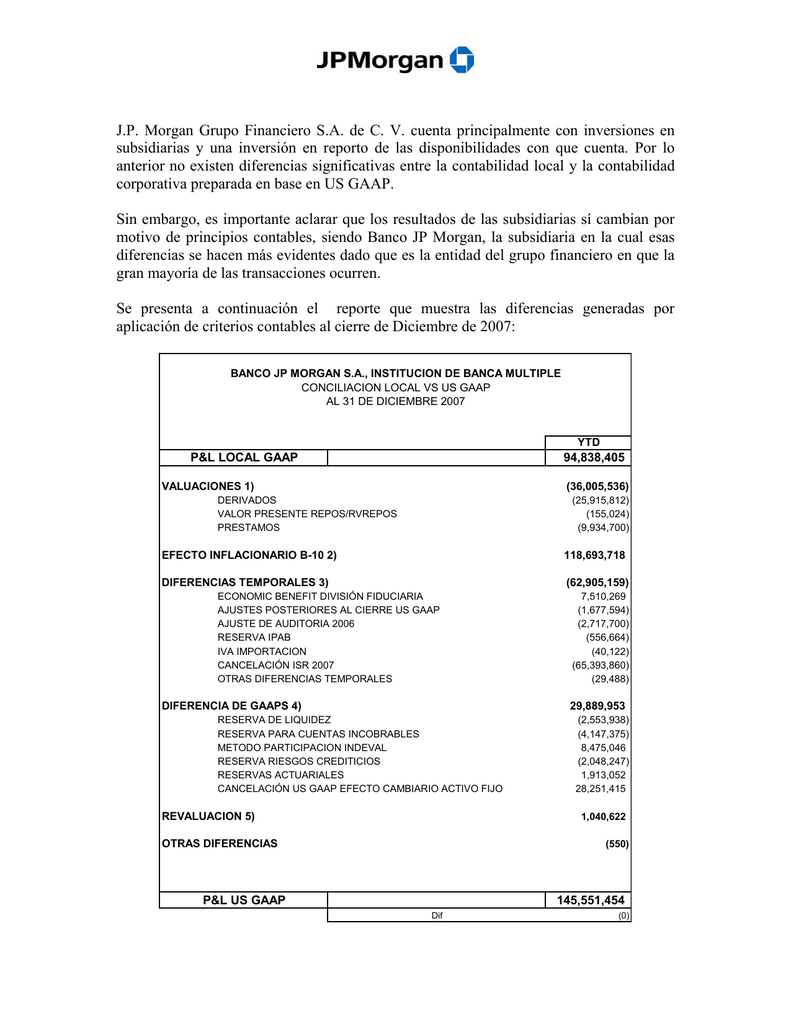

IFRS versus US GAAP. Modelizamos el impacto del deterioro crediticio en la cuenta de pérdidas y. We collected the Forms 20-F of all Spanish companies listed in the US stock markets during the period 19912001 and analyzed the reconciliations to NI and SE to US GAAP.

Principales diferencias entre las NIIF y las US GAAP. So basically there are two big sets of accounting standards in the world. The Manager Accounting Policy is responsible for monitoring and compliance of LLA accounting policies.

NIIF versus US GAAP. Resumen Whats the role. But as of now US GAAP is still required for US firms.

6 IFRSs y US GAAP Una comparación de bolsillo. Similitudes A Continuación se mencionan algunas diferencias entre las NIIF y las US GAAP Importancia Metodología de conversión Estados Financieros NIIF. Financial Reporting Taxonomy Taxonomy contains updates for accounting standards and other improvements since the 2018 Taxonomy as used by issuers filing with the US.

US GAAP vs MX GAAP. We classified all reconciling items into a few categories and studied their frequency persistence significance and. For US GAAP requirements that are not yet fully effective this publication distinguishes the accounting.